How Long Does Your Generation Shop for Homes?

Posted On October 11, 2016

(Special Blog today comes courtesy of Zillow who researches generational trends on their users and homebuyers across the market place.)

By Jennifer Riner

Every generation offers specific trends, habits and lifestyles that sets them apart from their predecessors. Much like Generation X differs from their Baby Boomer elders, Generation Y thinks outside of the box when it comes to finding their perfect homes.

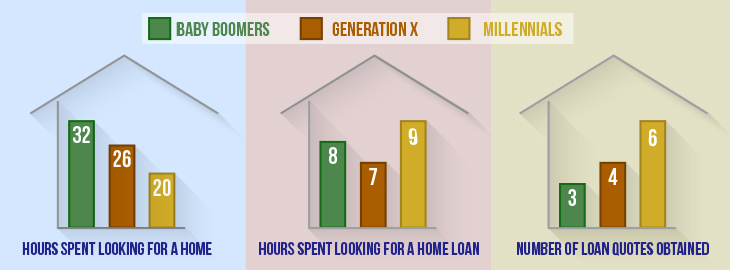

A recent Zillow survey conducted by Ipsos of 2,010 American adults revealed how home and mortgage shopping trends differ across age groups. Regardless of generation, the average American spends 26 hours finding their perfect place and just eight hours shopping for a mortgage or refinance loan worth $147,680

Baby Boomers (age 55+)

On average, Boomers spend 32 hours researching homes on the market – the most amount of time devoted to the process of any age group. But, Baby Boomers spend far less time (eight hours) shopping for mortgage or refinance loans, despite home financing being the second most expensive purchase, on average. Slightly over half of Baby Boomers (55 percent) shop around for mortgage rates before they settle on a lender, but they obtain the fewest number of quotes at an average of three before settling on a loan.

Generation X (age 35-54)

Gen X buyers devote significantly less time to the process than Boomers. Gen X homebuyers spend 26 hours looking for houses, and they only devote seven hours to shopping for their mortgage or refinance loans. However, they’re slightly more thorough on finding a deal than Boomers. Approximately three-quarters of Gen X homebuyers ages 35 to 54 shop around and compare mortgage rates, obtaining an average of four quotes before deciding on one.

Millennials (age 18-34)

The youngest generation of homebuyers spends the least amount of time shopping for their homes but the most amount of time shopping for the loans to support their purchases. At 20 hours, on average, millennials are quickest at sifting through available home inventory and making a decision on where to invest. On the other hand, Millennials spend nine hours conducting research on mortgages, much longer than both Generation X (seven hours) and Baby Boomers (eight hours). Millennials are also more likely to compare rates, with 86 percent of 18- to 34-year-olds shopping around for a loan. Further, millennials obtain the largest number of lender quotes at an average of six – double that of Boomers.

All generations may put less time into shopping for a mortgage than they do shopping for a house itself, but the long-term costs of even the slightest deviations adds up. For a $300,000 loan, half a percentage less on a conventional 30-year fixed rate could save $26,000 in interest throughout the life of the loan.

Zillow recommends buyers, regardless of age, obtain at least three quotes before locking down their loans to get the best interest rate possible. Think you’ve got what it takes to be a savvy homebuyer? Take the quiz to see if you can commit to the biggest purchase of your life.