Millennials Fiscally Responsible

Posted On September 8, 2015

Last time, we looked at the benefits of financial benefits of millennials spending a couple extra years at home after leaving college. Now, Forbes tells us that millennials may be way ahead of the rest of us in terms of fiscal responsibility.

The magazine recently noted a T. Rowe Price survey that found millennials doing a better job of tracking their spending, sticking to a budget, and even taking advantage of things like 401(k) plans.

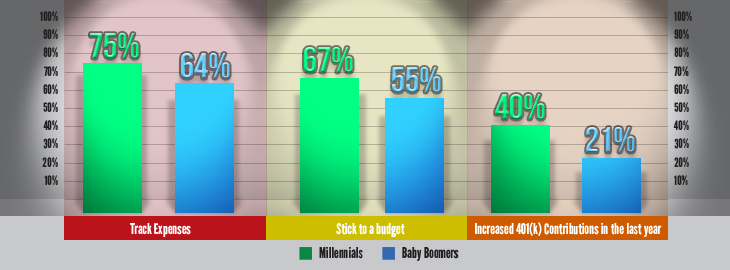

Among the survey’s findings:

- 75 percent of millennials surveyed say they track their expenses carefully, compared to 64 percent of Baby Boomers.

- 67 percent of millennials say they stick to a budget, compared to 55 percent of Baby Boomers.

- 40 percent of millennials have increased their 401(k) contributions within the last year, compared to 21 percent of Baby Boomers.

That last one isn’t terribly surprising, as Baby Boomers should be saving for retirement at high rates already with it right around the corner.

In addition, 88 percent of the millennials surveyed by T. Rowe Price said they believe they’re doing a good job of living within their means and 67 percent said they save “by any means necessary.”

All this might seem surprising since millennials are so often generalized as entitled and lazy, and since they have decades before they retire. But they have lived through the recession of 2008 and its lingering effects on job security and many of them also have substantial student-loan debt that forces them to think fiscally. The findings of the T. Rowe Price survey may be an indication that they’ve taken the recession’s lessons to heart.

Forbes quoted Emily Pachuta, head of investor insights at UBS, as drawing a parallel between the savings-conscious millennials and the Depression generation in dealing with uncertain job markets and volatile markets – and holding stubbornly onto their cash as a result.

But Forbes notes there is volatility with this “recession generation” as well. Significant numbers surveyed said they’d opt out of 401(k) plans if the percentage at which they were auto-enrolled went up.

Even “any means necessary” has its limits.