Can early financial literacy indicate future success? If so, look out.

Posted On July 24, 2014

According to an international report on financial literacy, recently released by the Organization for Economic Cooperation and Development, today’s teens are ill-equipped to make much more than basic spending decisions. And this could be a problem.

Financial planning demands are increasingly complicated. While Matures, and to some extent Boomers, were able to supplement pensions and corporate retirement plans with some personal financial planning, Xers, Millennials and iGen know that they are on their own. But has education kept pace with needs? It seems not.

The OECD report indicates there is work to be done, with more than 1 in 6 U.S. students failing even the most baseline questions. Companies that are relying on financially savvy employees may be in for a surprise.

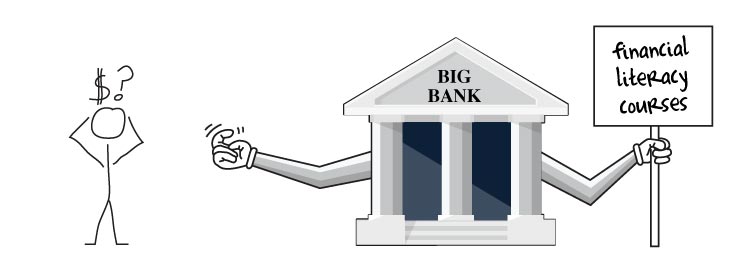

I like to think there is some opportunity to be found. Financial services businesses – from banks to brokerages – can be part of the solution by offering financial literacy courses as part of their community outreach. Share knowledge, help out future customers and employees, gain brand awareness…a win, win, win.