Falling in love with journalism despite the haters

Posted On March 14, 2024

Why would anyone want to go into journalism these days? It’s a consolidating industry where the jobs are decreasing, and the public seems increasingly hostile toward the profession. But people are still going into journalism, whether they be college students or others joining the trade later in life. Our guest in the latest episode of “What’s Working with Cam Marston” is someone who transitioned into the field from the financial industry, and considers herself lucky for having done so. Jill Schlesinger is a certified financial planner who moved into media and is now a business analyst at CBS News. She… Read More

Categories: Blog, Financial Services, Wealth, What's Working with Cam MarstonTurning a problem into a business (and transforming wealth transfer in the process)

Posted On November 21, 2023

Sometimes the problems life presents to us lead us to create new solutions. So it was with Martha Underwood, our guest in a recent episode of “What’s Working with Cam Marston.” Underwood had a family emergency in 2017, when her father fell from a roof while helping a neighbor clear debris after a hurricane and fell unconscious. Living in Birmingham, hundreds of miles away from her parents’ home in Miami, she found that finding and accessing his medical and financial information to make decisions on his behalf was problematic. “With my background, I said there has to be a better… Read More

Categories: Blog, Entrepreneurship, Wealth, What's Working with Cam Marston, WomenWomen are fueling a resurgence in millennial household incomes

Posted On March 5, 2019

We all know the economic issues with which the millennial generation has been saddled. We’ve all heard the stories of millennials moving back in with their parents and struggling to make ends meet while paying off exorbitant student loans. But there is good news: According to the Pew Research Center, incomes are rising and millennial households now earn more than young adult households of any generation in the last 50 years. The median income for a millennial household in 2017 was $69,000, less than $10,000 lower than the typical Baby Boomer household (just over $77,000). Generation X households, enjoying their… Read More

Categories: Blog, Generation Y / Millennials, Wealth, Women, WorkMillennials finding it tough to bounce back from Great Recession

Posted On June 16, 2018

We grouse about their participation trophies and helicopter parenting. We stereotype them as overly entitled and self-absorbed. We laugh about their reactions to pop culture standards from before they were born. But instead of mocking millennials, we should perhaps be worried about them. A new study from the Federal Reserve Bank of St.Louis found that many millennials have never gotten over the Great Recession of the late 2000s. The study found that the net worth of a typical family whose head was born in the 1980s, the front edge of the millennial generation, was 34 percent below expectations, and lost… Read More

Categories: Blog, Financial Services, Generation Y / Millennials, WealthDemystifying your paycheck: Who FICA is and why he’s taking your money

Posted On June 6, 2018

During an NBA career that spanned two decades, Shaquille O’Neal made more money per season than most of us will ever see in our lives. But when he got his first paycheck, he had a revelation with which most of us can relate: “Who the hell is FICA?” he famously asked. “When I meet him, I’m going to punch him in the face.” Michael Roe had a similar revelation, visiting his manager’s office after receiving his first paycheck to complain about being shortchanged. The experience inspired Roe to educate himself about personal finance and ultimately to create The Financial Millennial… Read More

Categories: Financial Services, Podcast, WealthWith Baby Boomers in Golden Years, ‘gray divorces’ are on the rise

Posted On April 2, 2018

As America’s Baby Boomers settle into retirement, it’s time for them to finally reap the rewards of their decades of hard work, take that trip they’ve been putting off, sleep in while the working world is racing itself to the office, enjoy spoiling the grandkids. And, increasingly, to get a divorce. According to the Pew Research Center, divorce among couples 50 and older doubled in the 25 years from 1990 to 2015, from 5 per 1,000 to 10 per 1,000, and tripled among couples 65 and older to 6 per 1,000. While that’s still only about half the rate of… Read More

Categories: Baby Boomers, WealthWho argues over money the most? (Spoiler: It’s not the kids, and it’s not the grandparents)

Posted On March 24, 2018

They are in their prime earning years, old enough to have moved into management positions but young enough to not be staring directly at retirement just yet. And yet, perhaps moreso than any other generation, Gen-Xers are stressed about money. In a story initially published by LearnVest, Forbes contributor Julia Chang cited a CompareCards poll that found more Gen X couples argue about money than Baby Boomers or millennials. Twenty percent of the Gen-X couples surveyed in the poll said they’d sparred over finances within the last month, compared to 17 percent of millennials and only 9 percent of Baby… Read More

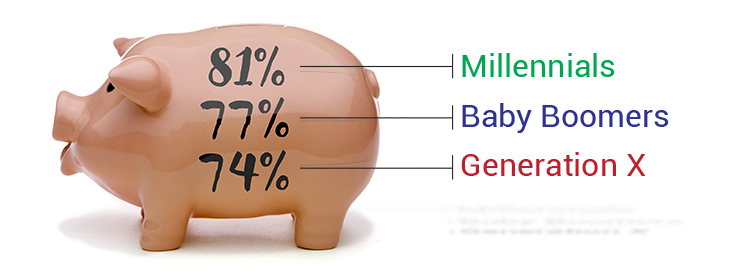

Categories: Financial Services, Generation X, WealthWho’s the best at feeding the piggy bank? You might be surprised.

Posted On January 21, 2018

Quick question: Which generation would you think is doing the best at saving for the future? Baby Boomers? They’re the closest to retirement, and therefore the benefits of saving should be most immediate to them. Generation X? They’re in their peak earning years, and should have the most resources from which to feed the piggy bank. Either would seem to make sense, and either would be wrong. According to a new Discover Bank survey shared on Nasdaq.com and elsewhere, it’s millennials who are doing the best job at saving. In a nation study of over 2,200 people, 81 percent of… Read More

Categories: Financial Services, Generation Y / Millennials, WealthAre Millennials, online shopping taking a bite out of Black Friday?

Posted On November 29, 2017

Is Black Friday fading? It depends on who you ask. Anecdotal evidence around the country seemed to indicate that the traditional Friday-after-Thanksgiving shopping spree wasn’t as big a free-for-all as in past years, but Forbes cited numbers from the National Retail Federation and Prospect Insights & Analytics that showed turnout to be higher than expected. Meanwhile, Bloomberg reported that online spending on Black Friday was a record $5.03 billion, according to Adobe Systems Inc. — up nearly 17 percent over last year. We didn’t even wait for Cyber Monday. The ease of online shopping has taken a bite out of… Read More

Categories: Advertising, Generation Y / Millennials, WealthThe good, the bad, and the … stay tuned!

Posted On October 2, 2017

This week the Federal Reserve released the 2016 Survey of Consumer Finances (SCF). The SCF is one of the largest (over 6,000 households were interviewed for the 2016 survey), comprehensive and representative surveys to track patterns of household spending, income, wealth and investment. Conducted every three years since 1989, the SCF provides analysts – including demographics geeks like us – a treasure trove of information. You might have already seen news stories documenting things like educational and geographic differences in income. One of the big questions being asked this time around is whether or not household wealth has recovered to… Read More

Categories: Financial Services, Generation X, Wealth